japan corporate tax rate 2017

And 31 March 2017 Tax rates for companies with stated capital of JPY 100 million or greater are as follows. Taxed on their Japanese-source income and on foreign-source income paid in or remitted into Japan.

Corporate Tax Reform In The Wake Of The Pandemic Itep

Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies.

. Beginning between 1 April 2015 and 31 March 2017 and 50 percent for fiscal years beginning on or after 1 April 2017. Tax year beginning after 1 Apr 2018. Overview Size-based business tax is a component of Enterprise tax and is levied on a companys business scale not on the size of its profit.

Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits. The corporate tax rate in Japan for a branch is the same as for a subsidiary. Japan Tax Profile Updated.

332 Corporate income taxes and tax rates The taxes levied in Japan on income generated by the activities of a corporation include corporate tax. Corporate inhabitants tax - Prefectural standard 4 08 13 13. 4890 Dec 31 2015.

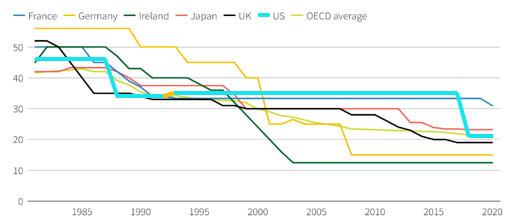

However a branch and a Japanese company have differing legal. The United States statutory corporate income tax rate is 1592 percentage points higher than the worldwide average and 95 percentage points higher than the worldwide average weighted by gross domestic product GDP. Special local corporate tax rate is 93 5 percent which is imposed o n taxable income multiplied by the standard of.

50 of taxable income. Dec 2014 Japan Corporate tax rate. World Bank Japan Japan Corporate Tax Rate.

From To Rate 112017 31122017 17 112015 31122016 18 112014 31122014 19 There is a cap on the amount of. The annual Special Basic Rate below is charged instead of delinquency tax. A 10 tax credit for the promotion of income growth where a company raises wages by at least 5 from the base year and meets certain other criteria for fiscal years beginning on or after 1 April 2013 until 31 March 2017.

Effective Corporate Tax Rates With Uniform and Country-Specific Rates of Inflation in G20 Countries 2012 37 Figure B-4. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. In 2017 Japan amended its CFC legislation to adjust the rules with some of the recommendations provided in the OECD BEPS project.

And A tax credit for job creation ie. But if the company is Medium and small sized company the taxable income limitation does not apply. Donations and the corporate income tax rates are the same for both a branch and a Japanese company.

Under the 2020 Tax Reform Act the currently effective consolidated tax regime would be abolished and replaced with a new regime of group relief group tax relief. Special local corporate tax rate is 4142 percent which is imposed on taxable income multiplied by the standard of. Our company registration advisors in Japan can deliver more details related to the corporate tax in this country.

Rate The national standard corporation tax rate of 232 applies to ordinary corporations with share capital exceeding JPY 100 million. Statutory Corporate Income Tax Rate in Japan as of April 2014 1. Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits.

The tax basis consists of three factors. Effective Corporate Tax Rates With Alternative Allocations of Asset Shares in G20 Countries 2012 34 Figure B-2. A Look at the Markets.

5040 Dec 31 2014. Corporate - Group taxation. Period if the corporation has been granted a filing or tax payment extension for income tax inheritance tax and gift tax.

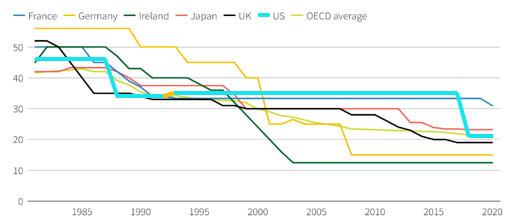

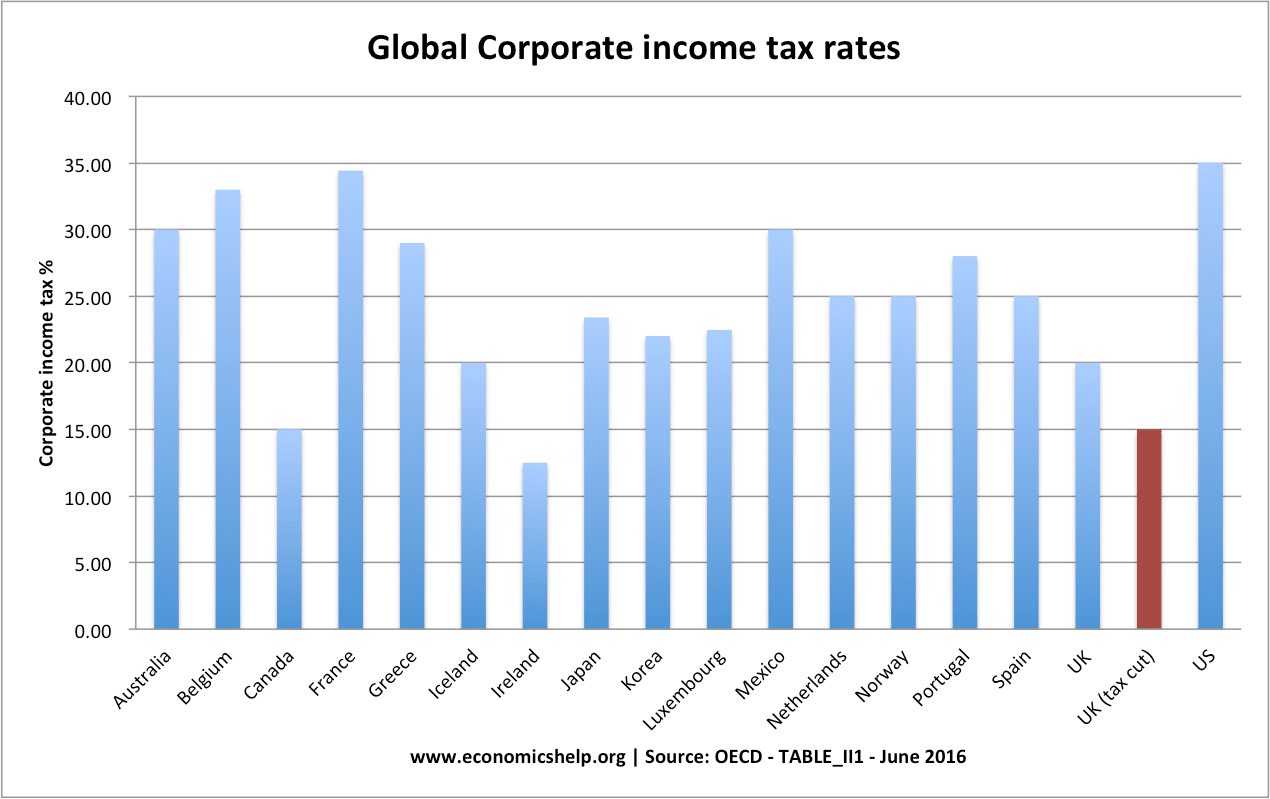

Effective Corporate Tax Rates With Alternative Rates of Inflation in G20 Countries 2012 35 Figure B-3. Central government tax 3 190 255 255. The worldwide corporate tax rate has declined significantly since 1980 from an average of 38 percent to 2296 percent.

Corporate income tax. Dec 31 2017. Size-based business taxation in Japan July 2017 1.

5040 Dec 31 2013. Japan had a worldwide tax system until 2009. Last reviewed - 02 March 2022.

Biden visits Illinois farm to highlight Russia-driven food inflation. 60 of taxable income. As from 2017 nonpermanent residents also are taxable on capital gains from the sale of non-listed.

CFC rules were incorporated by Japanese legislation in 1978. Where a corporation hires new employees which has been. Japan Tax Profile Produced in conjunction with the KPMG Asia Pacific Tax Centre Updated.

The tax applies to corporate taxpayers with share capital of more than JPY100M at the end of a fiscal year. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. The second post of this series explains how the Controlled Foreign Corporation CFC rules work in Japan.

4880 Japan Corporate tax rate. The new regime will be effective for tax years beginning on or after 1 April 2022. June 2015 Produced in conjunction with the.

This page provides - Japan Corporate Tax Rate - actual values historical data forecast chart statistics economic. Tax year beginning between 1 Apr 201631 Mar 2017. The tax credit rate is calculated according to the following formula.

Japan Corporate Tax Rate History. The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387. 55 of taxable income.

Tax year beginning between 1 Apr 201731 Mar 2018. Japan 2017 Tax Reform Outline Outline which proposes a comprehensive reform to Japan corporate income tax tax incentives directors compensation and similar rules to increase the competitiveness of Japanese business globally. 4740 Dec 31 2016.

Increasedecrease Note 2 Tax credit. Taxable income 4 mln 8 mln 4 mln 8 mln.

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Corporate Tax Reform In The Wake Of The Pandemic Itep

Corporate Income Tax Definition Taxedu Tax Foundation

Does Cutting Corporate Tax Rates Increase Revenue Economics Help

Corporate Income Tax Cit Rates

Part V World Inequality Report 2018

A Quick Guide To Taxes In Japan Gaijinpot

Corporate Taxes Rates Down Revenues Up Cato At Liberty Blog

Capital Gains Tax Japan Property Central

Corporate Income Tax Definition Taxedu Tax Foundation

Corporation Tax Europe 2021 Statista

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

G7 Backs Global Corporate Tax In First Step Towards Reform Economist Intelligence Unit

Corporate Income Tax Definition Taxedu Tax Foundation